ANALISIS KEPATUHAN WAJIB PAJAK BERDASARKAN REALISASI PENERIMAAN PBB PADA BPPKAD KABUPATEN PURWOREJO

Abstract

Land and Building Tax (PBB) is a Regional Tax as one of the key sources of regional income to pay local government administration in order to establish a realistic and accountable regional autonomy. Therefore, tax payer compliance in meeting their tax collection obligations is required. The achievement of revenue targets and Building Tax (PBB) demonstrates tax compliance. This research was conducted in the BPPKAD Purworejo Regency. In this study, the author investigates the Taxpayer Compliance Analysis Based on PBB Revenue. The aim of this research is to determine what proportion of PBB tax income is collected depending on tax compliance (PBB). This study employs descriptive method, and data is collected from BPPKAD Purworejo Regency and processed by examining the proportion of realized land and building tax collections (PBB). The result reveal that the number of Land and Building Tax payers increases annually from 2016 to 2019. The rise in the number of tax payers means that the potential for PBB revenue will increase every year. For the realization of PBB revenue level Land Tax payer compliance and buildings (PBB) of Purworejo Regency, namely paying taxes as considered necessary.

Downloads

References

Adiati, A. K., Paravitasari, D., & Wulandari, T. R. (2017). Analisis Pajak Reklame di Kabupaten Purworejo Periode 2012-2016. Jurnal Akuntansi Dan Pajak, 18(01).

Ayu, N. T. (2009). Pelayanan Penentuan Nilai Jual Objek Pajak Bumi Dan Bangunan Yang Dilaksanakan Fiskus Di Lingkungan Setia Budi Kelurahan Asam Kumbang Medan [Universitas Sumatera Utara]. https://123dok.com/document/7q06jl3q-pelayanan-penentuan-bangunan-dilaksanakan-fiskus-lingkungan-kelurahan-kumbang.html

Dewi, S. P. C. (2017). Analisis Kontribusi Pajak Bumi Dan Bangunan Dalam Meningkatkan Pendapatan Asli Daerah Kabupaten Lampung Barat Tahun 2012-2015 (Studi pada Dinas PPKAD Kabupaten Lampung Barat) (Doctoral dissertation, IAIN Raden Intan Lampung).

Fernandes, R. (2021). Analisis Kontribusi Penerimaan Pajak Bumi dan Bangunan Perdesaan dan Perkotaan (PBB-P2) Terhadap Pendapatan Asli Daerah Kota Padang Panjang.

Hanindha, W. D. (2017). Analisis Tingkat Kepatuhan Wajib Pajak Dalam Membayar Pajak Bumi dan Bangunan (Studi Kasus Badan Pendapatan Daerah Kabupaten Mojokerto) (Doctoral dissertation, University of Muhammadiyah Malang).

Hutabarat, D. T. H., Fransisca, Z., Ritonga, F., Pardede, D. J., Almas, S., Sikumbang, N. A., Mutiara, Khoiriyah, A., Hamizah, S., Malahayati, & Suryadi. (2022). Understanding And Describing Relationship Of State Law And Human Right. Journal of Humanities, Social Sciences and Business (JHSSB), 1(1), 65–72. https://doi.org/https://doi.org/10.55047/jhssb.v1i1.63

Indrawan, N. L., Arba, & Munandar, A. (2021). Juridicial Review Implementation of Land Registration According to Government Regulation No. 18 of 2021 Concerning Management Rights, Land Rights, Flat Units and Land Registration. Policy, Law, Notary And Regulatory Issues (POLRI), 1(1), 39–56. https://doi.org/https://doi.org/10.55047/polri.v1i1.27

Kamaroellah, R. A. (2017). Analisis Kepatuhan Wajib Pajak Bumi dan Bangunan Berdasarkan Realisasi Penerimaan Pajak Bumi dan Bangunan (PBB) pada Dinas Pendapatan Daerah Kabupaten Pamekasan. IQTISHADIA Jurnal Ekonomi & Perbankan Syariah, 4(1). https://doi.org/10.19105/iqtishadia.v4i1.1158

Luthfiyah. (2010). Potensi Penerimaan Pajak Bumi dan Bangunan (PBB) pada Kantor Pelayanan Pajak Pratama Medan Barat. Universitas Sumatera Utara.

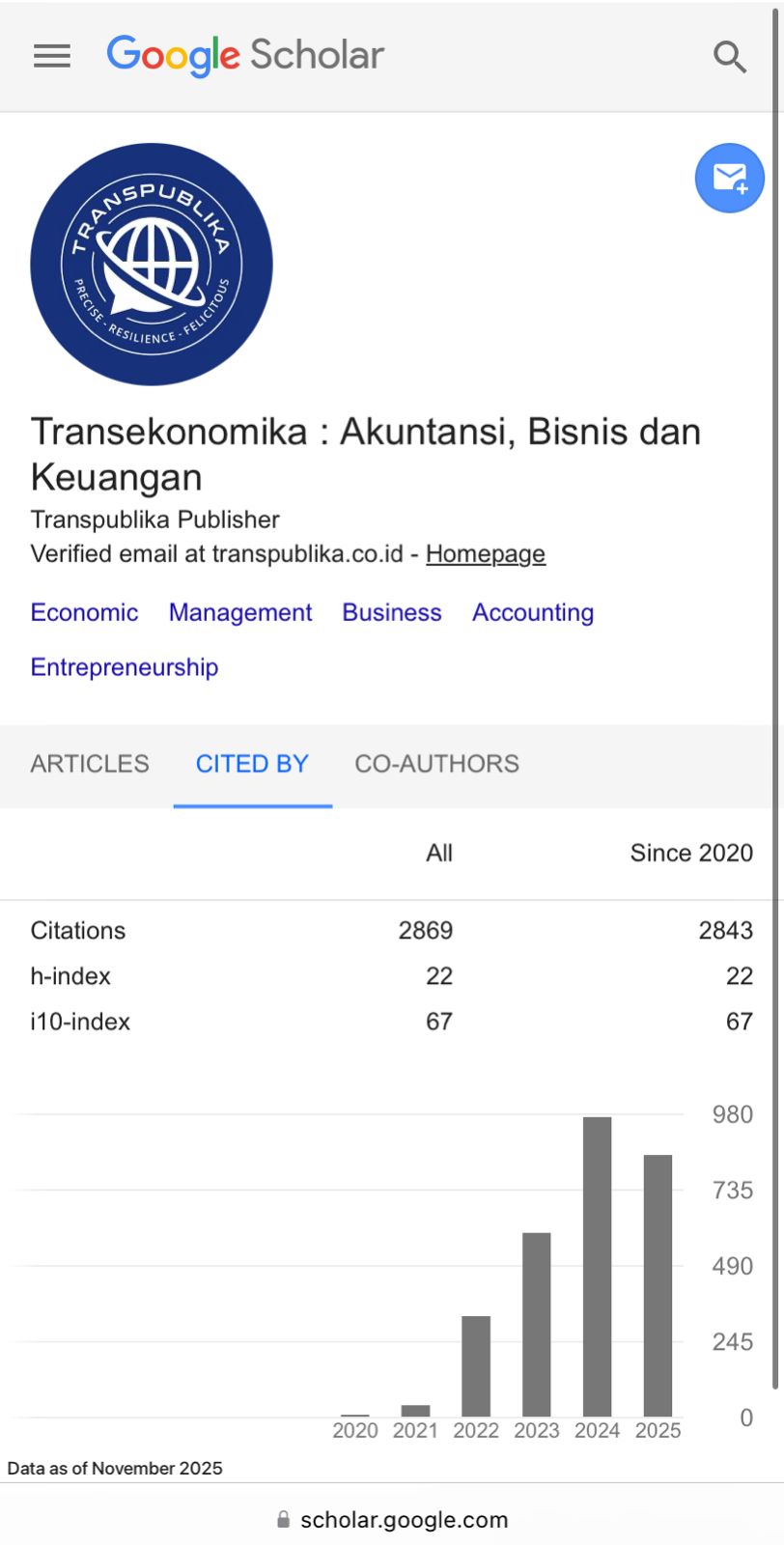

Prasetyowati, H., & Panjawa, J. L. (2022). Teknologi Dan Distribusi Pajak Mendukung Kualitas Pembangunan Manusia. Transekonomika: Akuntansi, Bisnis Dan Keuangan, 2(2), 23–36.

Sijabat, R. M. O. (2019). Analisis Efektivitas Penerimaan Pajak Bumi dan Bangunan Pada Badan Pengelola Pajak dan Retribusi Daerah Kota Medan (Doctoral dissertation, Universitas Medan Area).

Sugiyono, D. (2013). Metode penelitian pendidikan pendekatan kuantitatif, kualitatif dan R&D.

Copyright (c) 2022 Inge Hasna Puspita, Supanji Setyawan

This work is licensed under a Creative Commons Attribution 4.0 International License.

.png)

.png)

.png)

.png)