The Effect of Financial Performance and Corporate Social Responsibility on Firm Value with Firm Size as a Control Variable

DOI:

https://doi.org/10.55047/transekonomika.v5i2.860Keywords:

Profitability, Corporate Social Responsibility, Firm Value, Firm SizeAbstract

The main objective of this research is to explore how financial performance and corporate social responsibility influence the value of companies in the consumer goods industry in Indonesia, using firm size as a factor to consider. The study will concentrate on companies listed on the Indonesia Stock Exchange from 2021 to 2023. The research will gather data from previous studies and select samples based on specific criteria. A total of 285 samples will be analysed in this study. The data will be analysed using panel data regression analysis, which is suitable for examining how the variables interact with each other over the designated time period. The results of this research indicate that companies with higher profitability, as measured by Return on Assets (ROA), tend to have a greater firm value. Conversely, there was no notable impact on firm value from Corporate Social Responsibility (CSR), implying that consumers and investors may not rate CSR initiatives highly when evaluating company worth. Furthermore, the variable of firm size was shown to have a significant influence on firm value, with larger companies usually having a higher firm value.

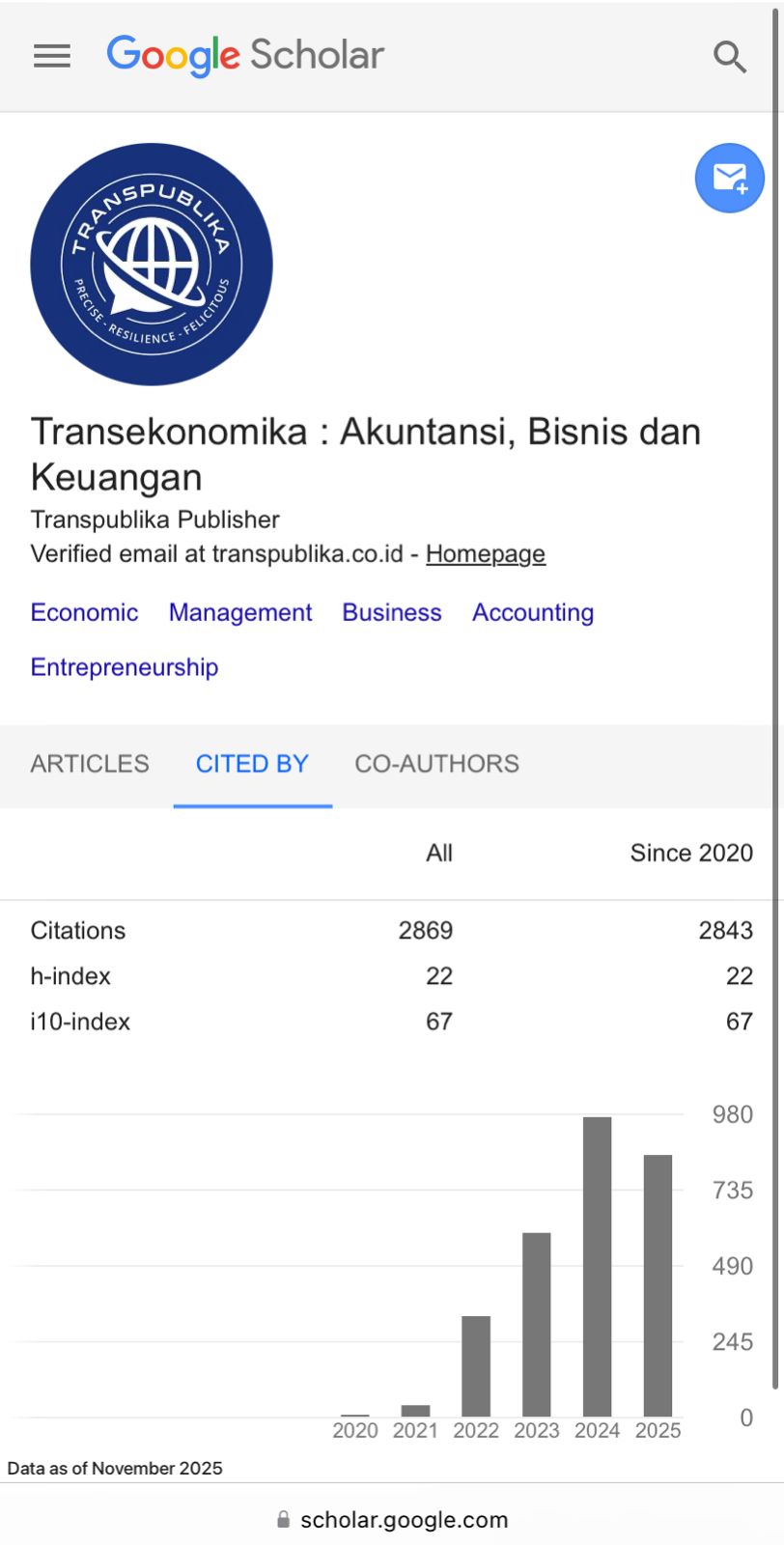

Downloads

References

Aminah, L. S. (2021). The Effect of Current Ratio, Net Profit Margin, and Return on Assets on Stock Return (Study on Food and Beverages Companies Listed on the Indonesia Stock Exchange 2015-2017 Period). MARGINAL : Journal of Management, Accounting, General Finance And International Economic Issues, 1(1), 1–9. https://doi.org/https://doi.org/10.55047/marginal.v1i1.8

Annur, C. M. (2024). Jumlah Investor Pasar Modal Indonesia Terus Bertambah hingga Akhir 2023. Databoks.

Astuti, H. H., Oktavianus, R. A., & Augustine, Y. (2019). Pengaruh Pengungkapan Corporate Social Responsibility Dan Kinerja Terhadap Nilai Perusahaan Dengan Tipe Industri Sebagai Variabel Moderasi. Jurnal Magister Akuntansi Trisakti, 5(2), 185–202. https://doi.org/10.25105/jmat.v5i2.5074

Bella Angraini, B. A., & Murtanto. (2023). Pengaruh Corporate Social Responsibility Terhadap Nilai Perusahaan Dengan Profitabilitas Sebagai Variabel Moderasi. Jurnal Ekonomi Trisakti, 3(1), 1823–1830. https://doi.org/10.25105/jet.v3i1.16424

Darsono, M. R. B. S. (2023). Pengaruh Kinerja Keuangan, Kesempatan Investasi, dan Corporate Social Responsibility terhadap Nilai Perusahaan. Diponegoro Journal of Accounting, 12(4), 1–12.

Haholongan, R. (2016). Kinerja lingkungan dan kinerja ekonomi perusahaan manufaktur go public. Jurnal Ekonomi Dan Bisnis, 19(3), 413.

HARSONO, A. (2019). Faktor-Faktor Yang Mempengaruhi Nilai Perusahaan Non Keuangan Yang Terdaftar Di Bursa Efek Indonesia. Jurnal Bisnis Dan Akuntansi, 20(2), 117–126. https://doi.org/10.34208/jba.v20i2.416

Lastanti, H. S., & Salim, N. (2019). Pengaruh Pengungkapan Corporate Social Responsibility, Good Corporate Governance, Dan Kinerja Keuangan Terhadap Nilai Perusahaan. Jurnal Akuntansi Trisakti, 5(1), 27–40. https://doi.org/10.25105/jat.v5i1.4841

Loekito, V., & Setiawati, L. W. (2021). Analisis Pengaruh Corporate Social Responsibility (Csr) Terhadap Nilai Perusahaan Dengan Variabel Kontrol Likuiditas, Leverage, Ukuran Perusahaan, Dan Profitabilitas Pada Perusahaan Manufaktur Yang Terdaftar Di Bursa Efek Indonesia Tahun 2017 – 2019. BALANCE: Jurnal Akuntansi, Auditing Dan Keuangan, 18(1), 1–26. https://doi.org/10.25170/balance.v18i1

Maulinda, W., & Hermi. (2022). Pengaruh Profitabilitas, Likuiditas, Dan Leverage Terhadap Nilai Perusahaan Dengan Corprate Social Responsibility Sebagai Variabel Pemoderasi. Jurnal Ekonomi Trisakti, 2(2), 1923–1932. https://doi.org/10.25105/jet.v2i2.14885

Patmarina, H., & Febriana, V. (2021). Pengaruh Good Corporate Governance Dan Ukuran Perusahaan Terhadap Kinerja Perusahaan Pt.Hm Sampoerna Tbk Periode 2008-2017. Angewandte Chemie International Edition, 6(11), 951–952., 26.

Pohan, H. tohir, Noor, I. N., & Bhakti, Y. F. (2019). Pengaruh Profitabilitas Dan Pengungkapan Corporate Social Responsibility Terhadap Nilai Perusahaan Dengan Ukuran Perusahaan Sebagai Variabel Moderasi. Jurnal Akuntansi Trisakti, 5(1), 41–52. https://doi.org/10.25105/jat.v5i1.4850

Prihayu, W. S., & Fitria, A. (2023). Pengaruh Kinerja Keuangan Terhadap Nilai Perusahaan Dengan Corporate Social Responsibility Sebagai Pemoderasi Astri Fitria Sekolah Tinggi Ilmu Ekonomi Indonesia (Stiesia) Surabaya. Jurnal Ilmu Dan Riset Akuntansi, 12(5), 1–21.

Rafid, A. G., Pohan, H. T., & Noor, I. N. (2017). Pengaruh kinerja keuangan terhadap nilai perusahaan dengan pengungkapan corporate social responsibility sebagai variabel pemoderasi. Jurnal Akuntansi Trisakti, 4(2), 245–258.

Rahmi, N. U., & Danantho, V. (2022). Pengaruh corporate social responsibility, capital expenditure, keputusan investasi dan leverage terhadap nilai perusahaan pada perusahaan sektor consumer goods yang terdaftar di Bursa Efek Indonesia tahun 2016-2019. Owner, 6(4), 4210–4218. https://doi.org/10.33395/owner.v6i4.1175

Santoso, B. A., & Junaeni, I. (2022). Pengaruh Profitabilitas, Leverage, Ukuran Perusahaan, Likuiditas, dan Pertumbuhan Perusahaan Terhadap Nilai Perusahaan. Owner, 6(2), 1597–1609. https://doi.org/10.33395/owner.v6i2.795

Sianipar, M. A., & Mulyani, S. D. (2019). Peran Investment Opportunity Set Sebagai Pemoderasi Pengaruh Kinerja Keuangan, Goodcorporate Governance Dan Corporate Social Responsibility Terhadap Nilai Perusahaan. Jurnal Akuntansi Trisakti, 4(2), 85–100. https://doi.org/10.25105/jat.v4i2.4842

.png)

.png)

.png)

.png)